Here are some changes that have cropped up since the book’s publication:

Updates since the 2nd edition was released:

The government of Canada launched a whole new registered account call the First Home Savings Account (FHSA). Many financial institutions were slow to roll out FHSA accounts, though there are many options now (2024) that allow you to invest within one (including Questrade). The FHSA is unique in several ways: your contribution room is created by opening the account, and you have just 15 years to use the account. If you are a renter/live with your parents, you can treat it as extra RRSP room, with the plan to roll it into your RRSP at the end of the 15 years if you don’t purchase a home. Or you can use it as intended, saving up to $8000 per year for up to a total of $40,000 on a pre-tax basis, then being able to use those funds tax-free when purchasing a home. In both cases the 15-year limit is not likely going to be a constraint (though you may not necessarily feel the need to open one the day you turn 18, as then you’d have to buy before age 33, which has become a difficult prospect in Canada), so go ahead and open a FHSA even if you can’t immediately contribute. You can do catch-up contributions of up to one year’s contributions at a time, so if you opened an account and waited a few years to actually try saving in it, accumulating room, you could then contribute $16,000 when you were ready, then $16,000 again (if you had that room accumulated), then $8000 to max it out in 3 years (assuming it had been open for at least 2 before you started).

Referral codes: I included some referral codes in the footnotes for those that were interested in getting a bonus for themselves and helping me out, unfortunately those programs have changed over time. For Tangerine, they still have “Orange Keys”, but they put a (very low) cap on the number of referrals so my orange key is unlikely to help you. If you ask around, it’s pretty likely one of your friends or family has an account and you can use your referrals. For Questrade, they cancelled the old referral system (in the first edition), and the QPass should still work but they seem to randomly not apply it at times, instead they have a new referral link (click here) for the $50 bonus.

Determining your risk tolerance and what to invest in with a FHSA will be especially difficult — do you consider it short-term savings for a home purchase in single-digit years, or is it really extra RRSP room for a lifelong renter who should invest for the long term?

Questrade has released a new interface for their desktop/web trading platform. It looks like a bad compromise for mobile users, with only partial information displayed on several pages. For example, your positions now show either the number of shares and total value, or the share price. Three columns is not hard to fit on a screen… In the trading screen, it is now a multi-step process: first choose limit order, then number of shares, then price, etc. This is a mixed bag. On the plus side, it forces your attention to one step at a time, which may help reduce mistakes. You can also click on “change balance display” to only display your cash available balance so you don’t get mixed up with what they’ll let you borrow on margin. The cons are that it takes longer to enter an order, and is annoying if there is any interplay between the number of shares you want and the price you want to enter: you may have to move back a step to adjust your quantity, then forward again to enter your new price. Another big con is that the order review does not display the ECN fees. Instead, an ETF purchase order shows $0.00 commission, then an asterisk to some fine print that says ECN fees may apply.

If you want to go back to the way things were, you can add the old platform, called Questrade Edge. In the top-left menu (while in Trade), click on All Platforms, then click on the Questrade Edge tab on the top, then finally the Add Questrade Edge button. When you go back to Trade, you’ll see the old (Edge) platform.

National Bank Discount Brokerage has taken their commissions to zero (and no ECN fees in the fine print that I can find). I haven’t had a chance to open an account myself yet to get a first-hand experience with it, but it’s compelling. However, I will note that the existing options (e.g., Questrade) were practically free, and even paying $9.99/trade is not going to cause you to miss your financial goals. If you’re happy with your current brokerage, please don’t feel any pressure to switch. Plus there’s a decent chance that in the next year or two other brokers may follow suit. In the meantime, while the interface may be a bit different than the TD and Questrade examples detailed in the book, the general mechanics of placing a trade for an ETF (limit orders, ticker symbols, etc.) will still apply and I have faith that you will be able to figure it out.

Robo-advisors are an attractive idea for people who want a more hands-off solution, and the Second Edition of the book had section on them. There, I mentioned a comparison tool we had created called AutoInvest. Unfortunately, AutoInvest has been taken down by its new owners.

Tangerine has introduced a new set of all-in-one mutual funds with lower fees. They included “ETF” in the name of the funds, which is needlessly confusing — though the funds may invest in ETFs on the back-end, they are still easy-to-use one-stop mutual funds and not ETFs themselves. The new lower fees make them very competitive with robo-advisors, though the funds are so new that we don’t have a lot of details on what exactly they’re holding — though we can trust that it will be a basic passive portfolio that’s likely very similar to the more expensive existing funds (though life would have been easier if they just lowered the fees on the existing funds).

If you’re currently investing with Tangerine, they made it quite easy to change to the new, lower-fee funds. In your investment account, there’s a big “Switch my portfolio” button. You’ll have to repeat your risk tolerance questionnaire, then will have the option to choose a fund (or “portfolio” as they call it).

TD e-series funds are changing their benchmark indexes to Solactive ones, and reducing their management fees by 5 bp (0.05 percentage points).

The TD e-series funds are also available at other discount brokerages — they’re no longer a TD exclusive! You just need to know the fund code and how to place an order. While each brokerage is a little bit different, you should be able to figure it out based on the TDDI instructions in the book.

Vanguard released a set of all-in-one ETFs that combine globally diversified equities with global bonds. The tickers are VEQT (100% equities); VGRO (80% equities, 20% bonds); VBAL (60% equities, 40% bonds); VCNS (40% equities, 60% bonds); VCIP (20% equities, 80% bonds). The MERs aren’t officially reported yet (they need a year of history) but are projected to be around 0.24% (management fee of 0.22% plus minor other expenses).

iShares also came out with comparable all-in-one ETFs XEQT (100% equities), XGRO (80% equities, 20% bonds), XBAL (60% equities, 40% bonds), XCNS (40% equities, 20% bonds), and XINC (20% equities, 80% bonds). iShares is unique in offering a pre-authorized contribution plan, however only some brokerages accept it (Questrade is one of those). It is a nifty way to automate your purchases. For many years it was only offered on XGRO and XBAL, but in 2022 was updated to include the full lineup of all-in-one funds.

These are great options in my opinion for a few reasons:

-

- You’re forced to not slice-and-dice your allocation, just round off to the nearest 20%.

- Automatic rebalancing.

- Just one ETF to purchase, which can save commissions (if buying at a brokerage that charges commissions).

- All-in-one fund means that the benefits of diversification are unmissable: even if you had a hefty bond portion buffering losses in a market downturn, or were globally diversified if one equity sector was lagging, people often focus on the biggest and reddest number in their portfolio display and will still feel the stress at losses of seeing something down a lot. After all, it takes an extra conscious effort to view the portfolio as a whole. With an all-in-one fund you will only ever see the overall performance, which should work out better for many people.

These benefits come at a slightly higher cost. A few important caveats:

-

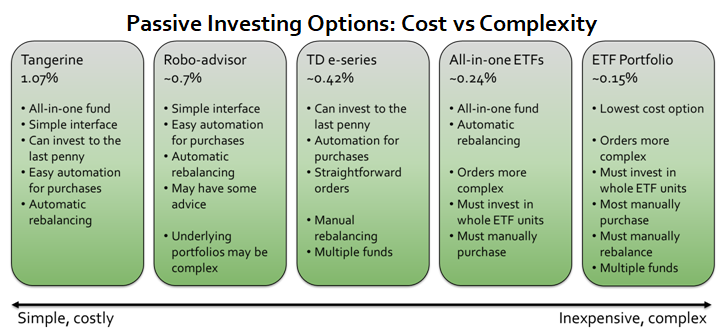

- The automatic rebalancing/single fund does not fundamentally change the spectrum of choices: TD e-series is still “easier” despite having four components, because it doesn’t involve orders on the stock market (don’t have to worry about limit orders, rounding down number of units) and purchases can be automated. I’ve created a new figure to lay the options out (below).

- If you go with one of these funds, you are paying a bit more for the all-in-one nature and automatic rebalancing. Trying to tweak that by adding other funds will break those features, so you may as well add one or two more funds and just go with a typical 3 or 4 fund ETF portfolio. To be explicit, if you want a portfolio of say 70% equities, 30% bonds, buying an even split of VGRO and VBAL will get you that at the beginning, but the allocation will start to drift and you’ll have to rebalance it yourself — so you’re paying a bit more in MER for a feature that’s no longer working for you; you could instead just add one or two ETFs to build the 70/30 portfolio yourself. Similarly for adding a particular sector to tweak your allocation (whether that’s adding extra bonds, or an all-world fund if you were trying to reduce the Canadian allocation).

Here’s a link to the blog post on them shortly after they were announced.

[Note in the figure above the e-series cost is the old cost — in 2020 and forward expect that to decrease to ~0.37%; Tangerine also introduced new funds at the end of 2020 that have lower fees — management fees of 0.65% which should put the MER just a bit above that, likely ~0.7%]

In the book I briefly touch on asset location, and suggested that the point is to save tax dollars rather than tax percentages (so tax shelters may be better used for high-expected-growth equities than high-tax-rate-but-low-expected-return bonds) — but also that the complexity is likely not worth it (and I am a fan of just repeating your asset allocation across all your accounts for simplicity). I also talk about how you have to treat your RRSP as pre-tax funds. But I didn’t do a good job of explicitly linking that to asset allocation, and that factor turns out to be why others say to put bonds in your RRSP. Here’s a very long blog post with more on that.

The book also introduces robo-advisors with a note of caution for non-registered accounts — the complex portfolios may be more trouble come tax time than the effort saved in automating the purchases. There were indeed a few complaints on social media from investors caught having to calculate their ACB on dozens or even hundreds of transactions, but a few firms have confirmed that they will do the work for you, including Justwealth, Nest Wealth, and Wealthsimple. This blog post has more details.

TD Direct Investing introduced a new feature in late 2018 that lets you transfer securities between accounts. Look for the new transfer button on the top menu bar. This will let you do your own in-kind contributions from a non-registered account to a TFSA/RRSP/etc. It will also let you journal DLR/DLR.U on your own, so there’s no need to call in to TDDI when doing Norbert’s Gambit. A few notes:

- You have to wait for the security to settle before it will show up as eligible for a transfer (you can’t journal DLR/DLR.U on the day you buy it). Likewise, it will take approx. a day for the move to take place to sell in the new account.

- For in-kind contributions, you are often restricted to contributing to the Canadian version of your account. So if you’re trying to contribute a US-listed ETF, you may have to first transfer from your USD non-registered account to your CAD registered account, wait for that to take effect, then transfer from your CAD registered account to your USD registered account.

Updates to the 1st edition:

The iShares High Quality Canadian Bond Index has changed its ticker symbol from CAB to XQB (see the table on page 98 of the paperback). Also from the same table, I omitted VCN as one of the options for Canadian equities (it is closer to XIC than VCE is).

As foreshadowed in the text, TD Direct Investing (Waterhouse) has implemented its switch to parallel Canadian dollar and US dollar RRSP accounts, which slightly changes the use of Norbert’s gambit for cheaply exchanging currency. Here is a PDF with a revised version of that section. Also, look below for further changes to TD’s interface.

In a footnote I provided a referral code for Questrade that would provide you with free trades. Given that most readers will be using free-to-trade ETFs there anyway, their new program providing cash bonuses for signing up is likely a better deal for you. The new referral code QPass 356624159378948.

The Federal government changed the TFSA contribution limits with the 2015 budget. People over the age of 18 in 2015 received $10,000 in contribution room. In 2016, the old system was put back in place, so you have $5,500 in new TFSA room for the year 2016, and this will increase with inflation in the future.

Vanguard has updated some of its index funds as of June, 2015. Of note is the international fund with the ticker VDU, which will now attempt to follow an index that includes a roughly 8% weighting to Canadian equities, excluding only the US market. This is, in my opinion, not a great change for Canadian investors, as it complicates asset allocation (albeit, not in a huge way — someone with a 33% weighting to VDU would now be ~2.6% overweight to Canada). The other options for international funds mentioned in the book have not changed as of yet. Because of this, XEF should be a better choice for international funds, or the new VIU replacement fund from Vanguard.

MoneySense has discontinued their directory of fee-only planners, I have created an alternative directory here.

In the book I suggested that contributing to your RRSP and deferring the deduction may be a good move if you were expecting to be in a higher tax bracket in the future. See this post for why that’s rarely actually good advice — if you’ve filled your TFSA room, you will likely prefer to either use your RRSP and take the deduction right away, or invest in a non-registered account until you’re actually in that higher tax bracket.

After publication, a new type of service started emerging: robo-advisors. These firms will help automate a broadly diversified investment strategy at a reasonable cost, usually less than what Tangerine charges, but typically higher than TD e-series. Though they are new, they may be a good option for some people. There are a lot of new firms in this area though, and they all have different pricing models, so it’s hard to say which will be best for you. I helped create a comparison tool to help you calculate which would be the cheapest for your situation, and to filter by various criteria. You may also enjoy this episode of Because Money on robo-advisors and the comparison tool, as well as this one on how they’re not quite perfect.

At the end of 2015, Questrade updated their interface. This major change now means that your statements and trading platform are in one place. I’ve updated the section of the book with the new step-by-step instructions — click here to download a PDF of that section.

For March 2016, the account fees at TD Direct Investing are changing. Rather than free non-registered and TFSA accounts, and a $25/yr charge for RRSP accounts under a certain size, the new account fee is $25/qtr ($100/yr) when all of your household accounts have less than $15,000 in them combined, and no fees when your household has more than $15,000 at TDDI. Moreover, these fees are waived if you have a systematic investment plan of $100/mo or more (i.e., if you’re automatically purchasing e-series funds every month). This is an improvement for people with small RRSPs looking to use e-series, and lets you use your spouse’s or parents’ account to get over the limit more quickly (if you live together), though for those who were starting out with smaller amounts in TFSAs this will force the use of automation. It also does away with the previous fee on RESP accounts that was unavoidable. Though the annual amount is higher, this new fee structure (with the easy way to avoid it entirely) should make TDDI an even more attractive choice over TDMF for e-series. I have also updated the section of the book on TD for the new interface (click here).

Some users have reported difficulty viewing the images in the Kindle version when using Amazon’s software readers (i.e., purchasing from Amazon to read on an iPhone or PC instead of on a Kindle device), and that the Kindle software is not enlarging the images. Here is a PDF of the figures and tables from the book that should help. Some images require context and can’t be posted separately.